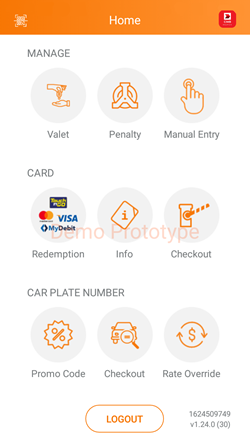

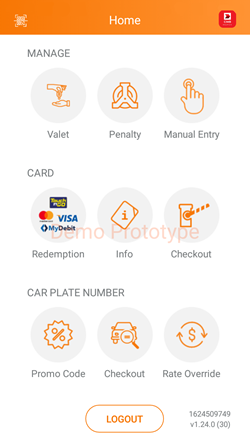

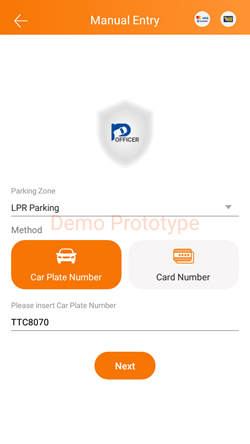

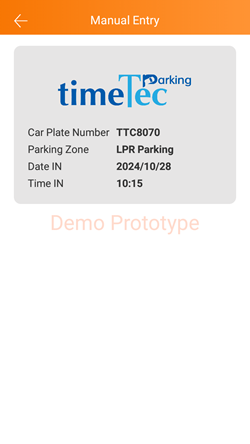

| TimeTec Parking Officer, a handheld device, offers a reliable solution for managing parking operations, especially during gate malfunction. Parking attendants can utilize this device to: • Manual Entry Creation: Input the vehicle plate numbers or scan card information to create parking entries. • Fee Calculation and Collection: Calculate parking fees based on entry and exit times. • Flexible Payment Options: Accept both cash and card payments. By leveraging TimeTec Parking Officer, parking operators can ensure smooth operations and minimal disruption to parking services, even in the face of technical challenges. |

|

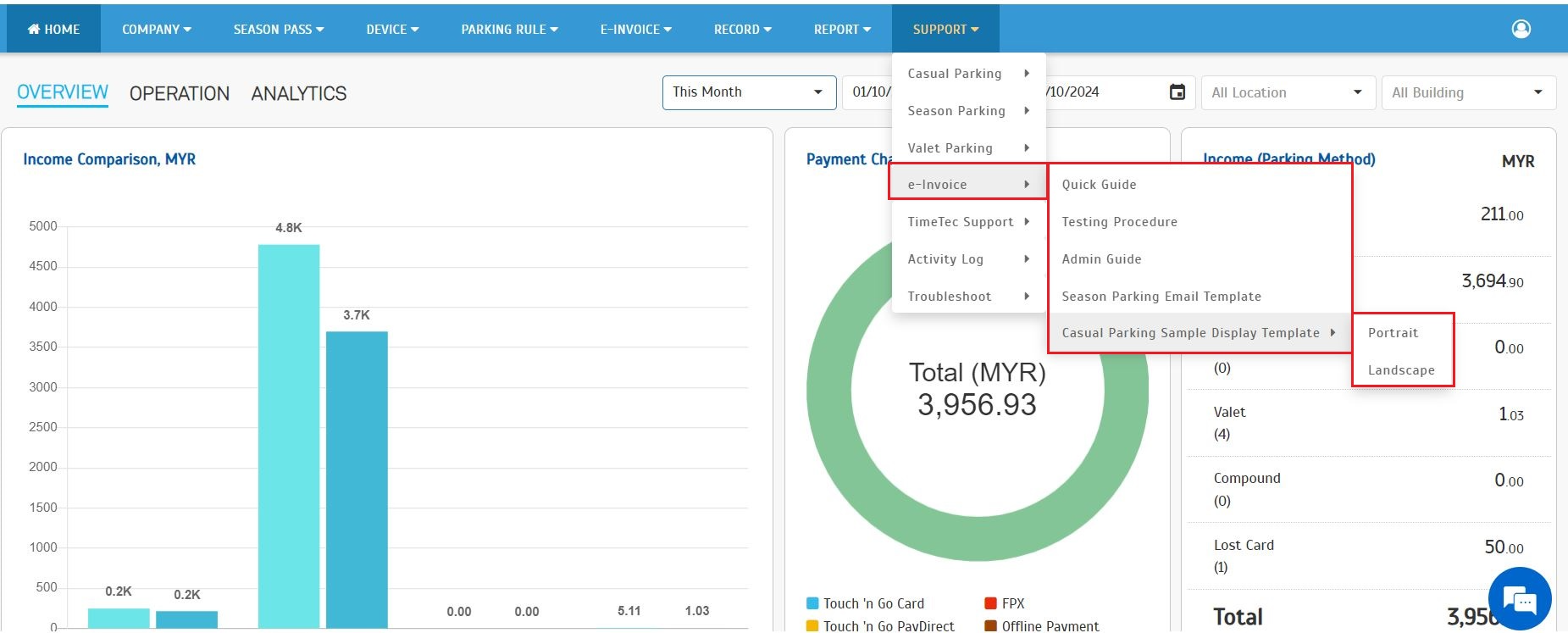

| We introduced a new E-Invoice Support menu to streamline the e-invoicing process. This dedicated menu provides users with essential resources to effectively manage e-invoices, including: • Guidance and Best Practices: Helpful tips and recommendations for optimizing e-invoice workflows. • Email Templates: Pre-designed email templates to facilitate communication with operators and customers. • Sample Display Templates: Visual examples of how the e-invoices should be displayed to ensure compliance with regulatory requirements. By providing a centralized hub of information and tools, we aim to empower users to navigate the complexities of e-invoicing with ease and confidence. |

|

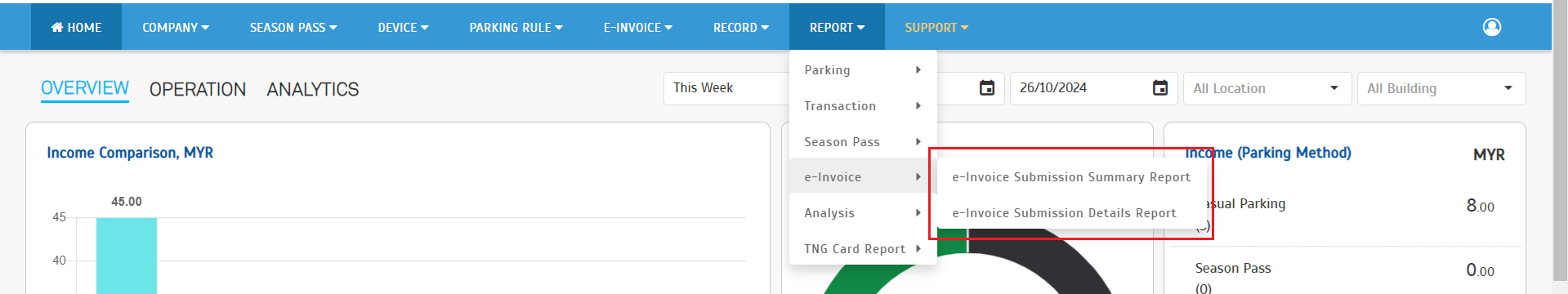

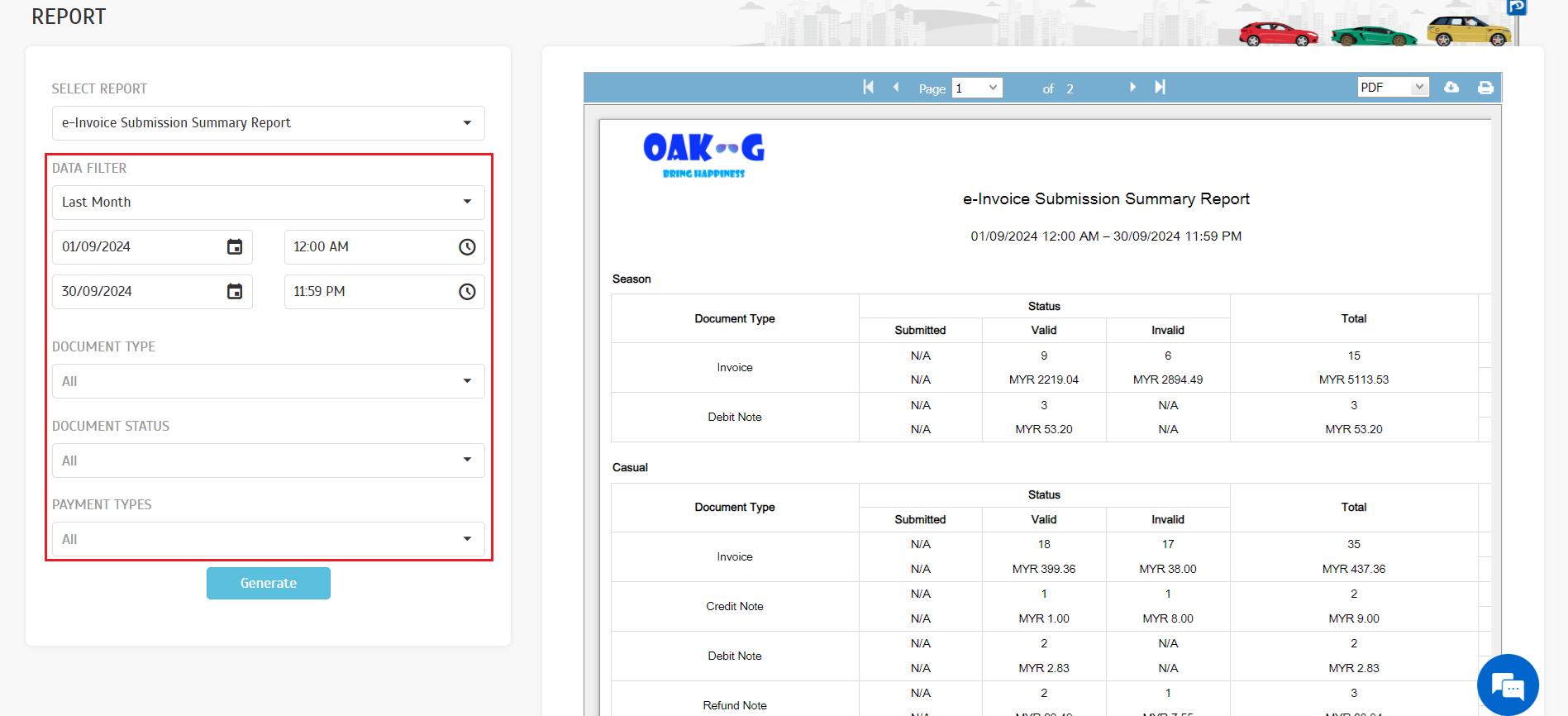

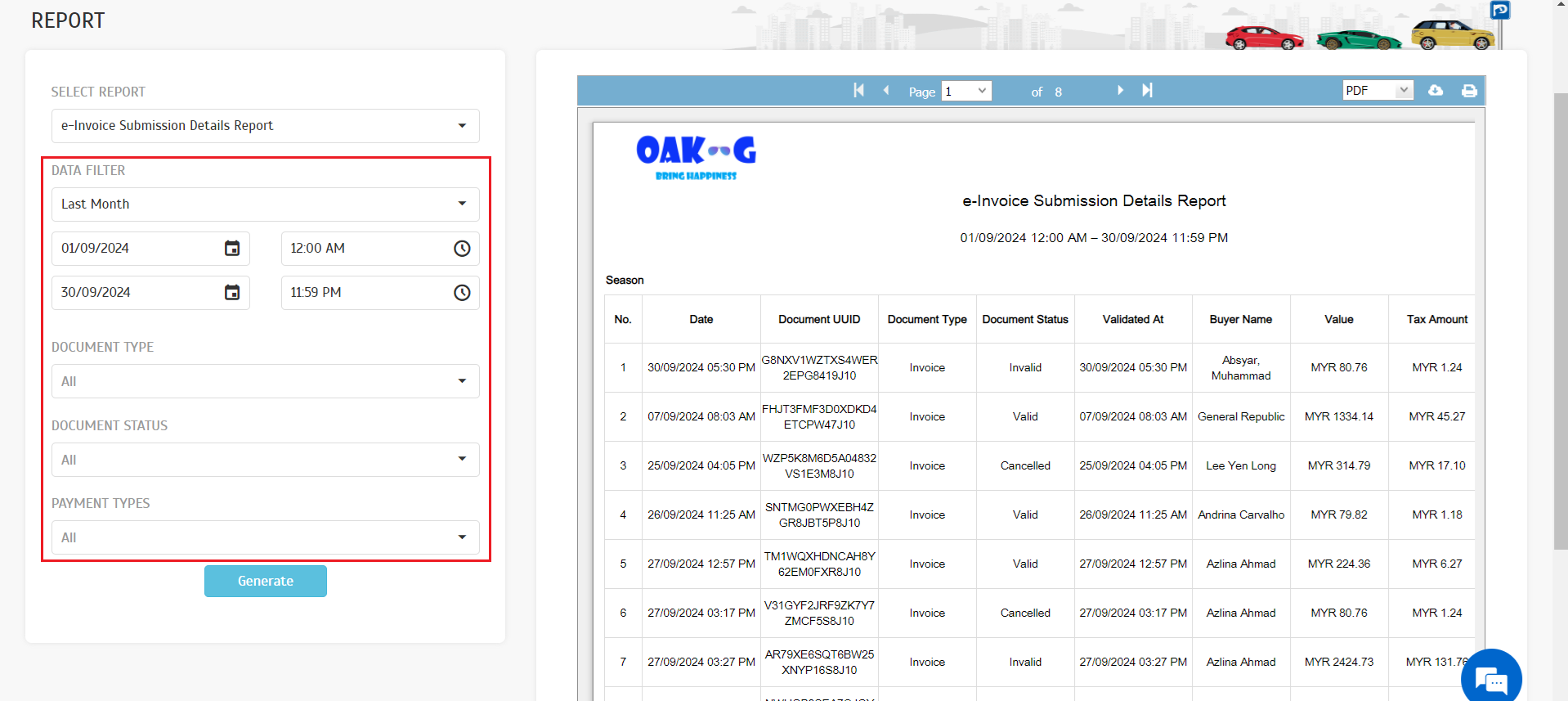

| We introduced a new E-Invoice Submission Report to provide valuable insights into e-invoice submissions. This report offers a detailed view of all submitted e-invoices, enabling operators to: • Track Submission Status: Monitor the progress of e-invoice submissions. • Identify Potential Issues: Quickly identify any errors or delays in the submission process. • Improve Efficiency: Analyze historical data to optimize future e-invoice workflows. By leveraging the customizable filters, operators can tailor the report to specific needs, such as filtering by date range, supplier, or invoice number. This granular level of reporting empowers organizations to make data-driven decisions and enhance their e-invoicing processes. |

||

|

||

|

||

|

||

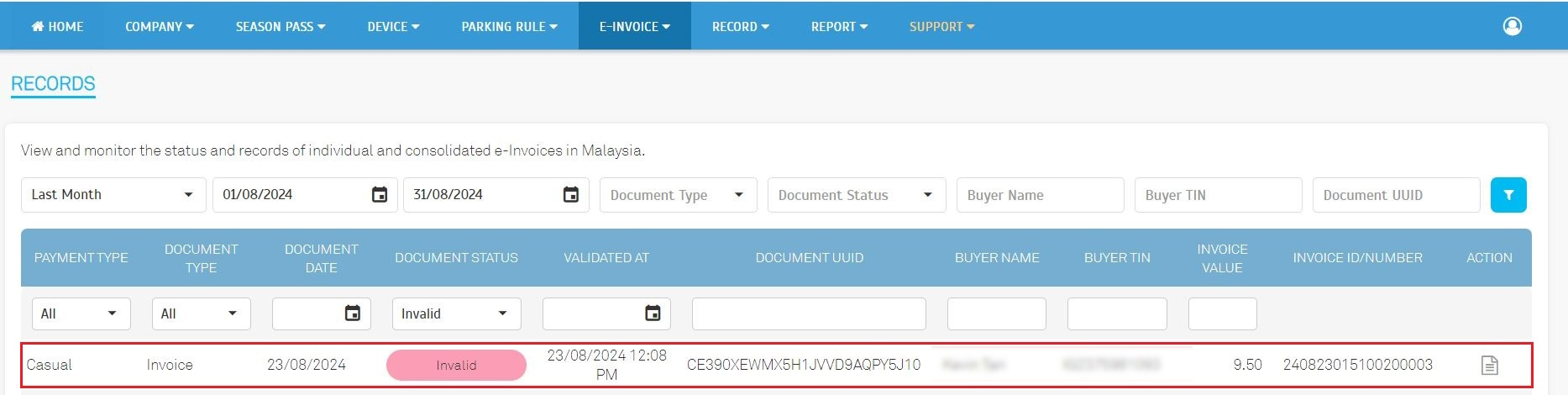

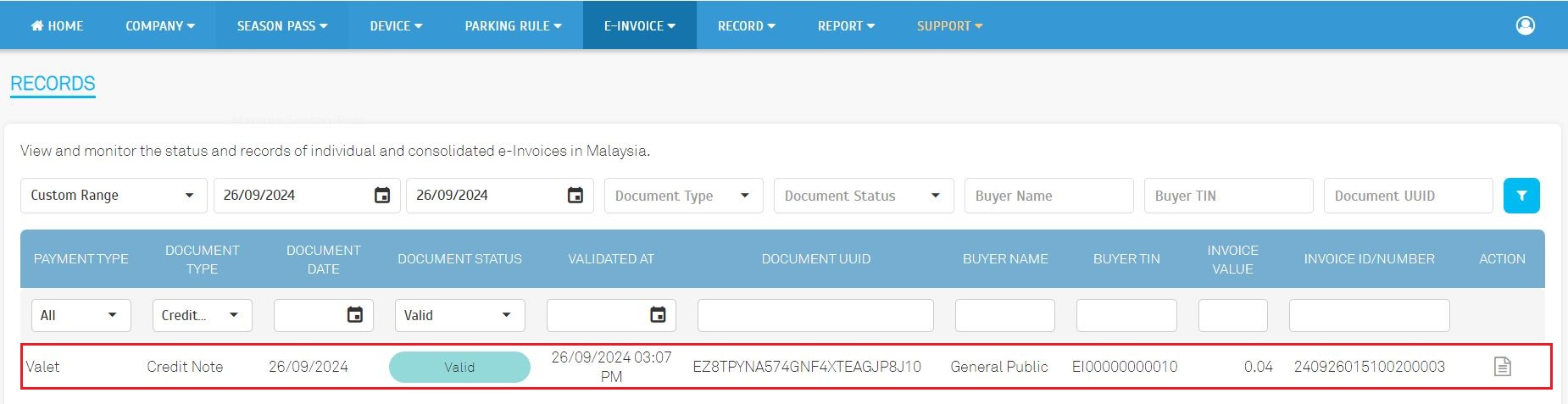

| Enhanced E-Invoice Error Handling and Individual Submission We implemented several improvements to the e-invoice submission process: Error Handling and Resubmission: • Operators can now identify and correct errors in invalid e-invoices. • Once errors are rectified, the e-invoice can be resubmitted for processing. Individual Submissions: • Operators can use either a General TIN (e.g., EI00000000010) or NA for individual submissions. • For company submissions, a valid TIN is mandatory. These enhancements provide greater flexibility and accuracy in e-invoice submissions, ensuring compliance with regulatory requirements and streamlining the overall process. |

||

|

||

|

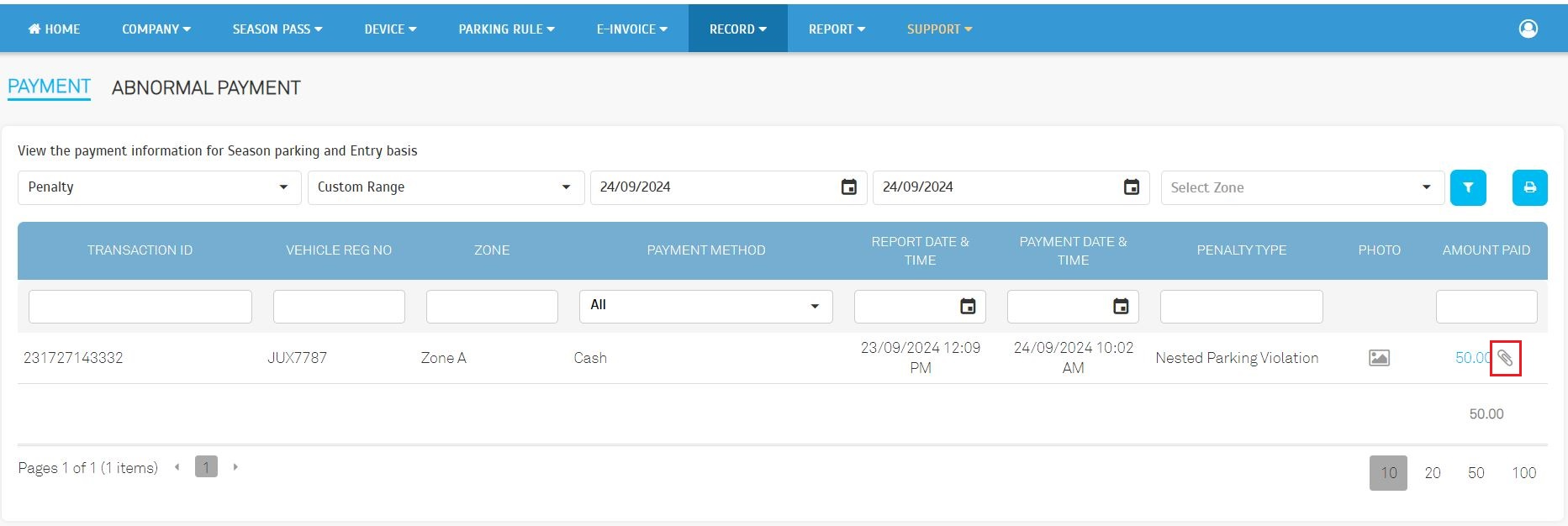

| We expanded our e-invoice export capabilities to include penalty records. This enhancement allows operators to export penalty collection data and seamlessly integrate it into their accounting systems. By exporting penalty records, operators can accurately report revenue generated from penalties or compounds to the relevant tax authorities, to ensure compliance with tax regulations. This feature streamlines the e-invoice submission process and minimizes the risk of errors or omissions. |

|

| We introduced a new feature that allows operators to review the detailed breakdown of invoices within each consolidated e-invoice submission. This enhancement provides greater transparency and control over the e-invoicing process. • Detailed Invoice Information: Access comprehensive information about individual invoices included in a consolidated submission. • Enhanced Accuracy: Verify the accuracy of invoice details, such as amounts, tax rates, and item descriptions. • Improved Compliance: Ensure that all invoices within a consolidated submission adhere to regulatory requirements. By providing a clear and detailed view of consolidated e-invoices, to help operators maintain accurate records, simplify the review process, and minimize the risk of errors. |

||

|

| We implemented a new feature to visualize and distribute e-invoices, debit notes, and refund notes. Once validated by the relevant tax authority (LHDN), the system generates a clear and concise visual representation of each document. • Clear and Concise Visualizations: Easily review the content of e-invoices, debit notes, and refund notes. • Enhanced Accuracy: Verify the accuracy of information, such as amounts, tax rates, and item descriptions. • Efficient Distribution: Automatically distribute visualized documents to customers via email. By providing a user-friendly way to view and share e-invoice documents, we streamline the e-invoicing process and improve communication with customers. |

|||

|

|||

|

|||

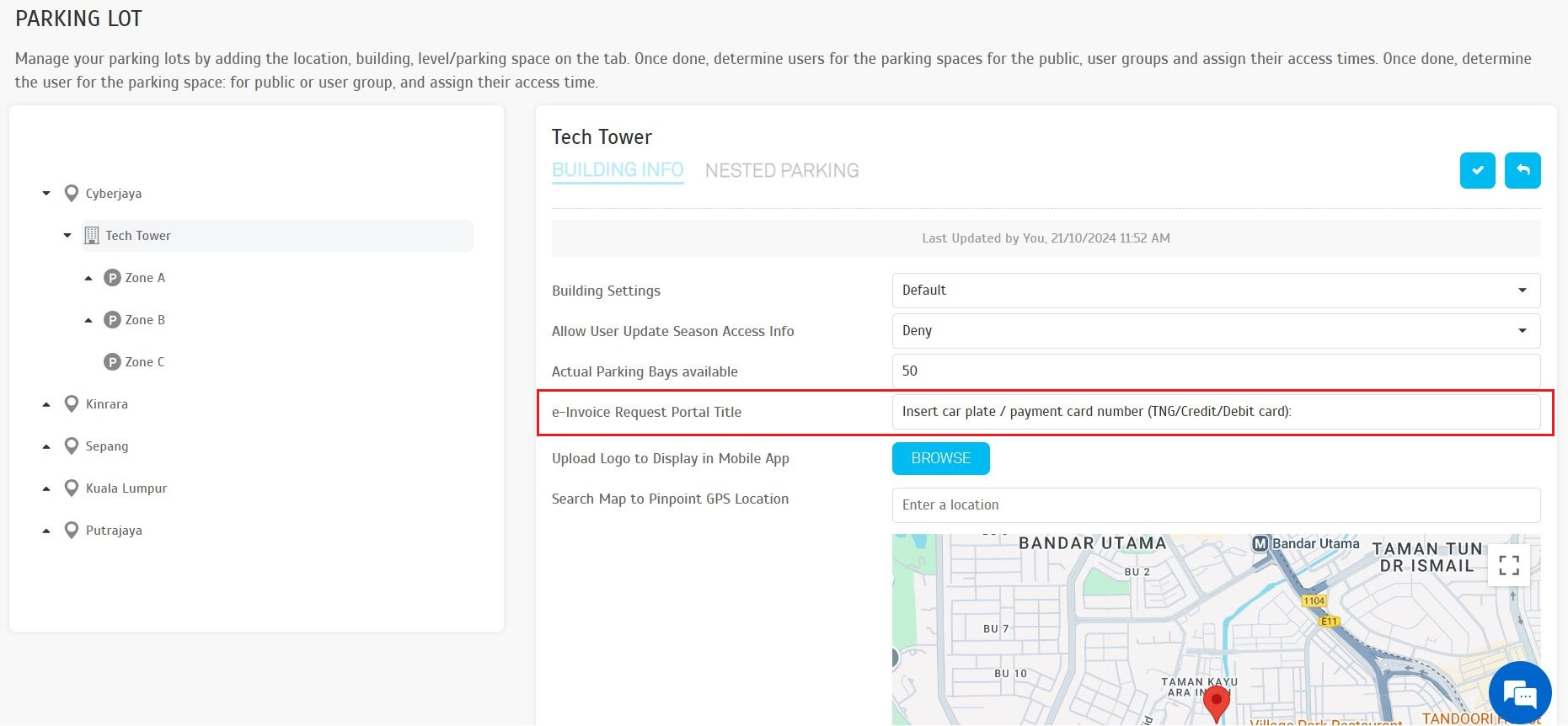

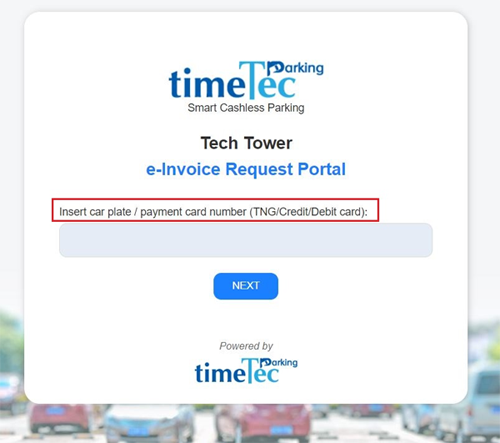

| Enhanced E-Invoice Request Portal Customization

We introduced a new customization feature for the e-invoice request portal. Operators can now tailor the titles displayed in the portal to provide clear and concise instructions to customers. This customization allows operators to: • Improve User Experience: Create a more intuitive and user-friendly portal. • Enhance Clarity: Clearly communicate the required information, such as customer ID, email address, or phone number. • Tailor to Specific Needs: Adapt the portal to different business scenarios and customer requirements. By providing the flexibility to customize the request portal, we empower operators to optimize the e-invoicing process and enhance customer satisfaction. |

|||

|

|||

|

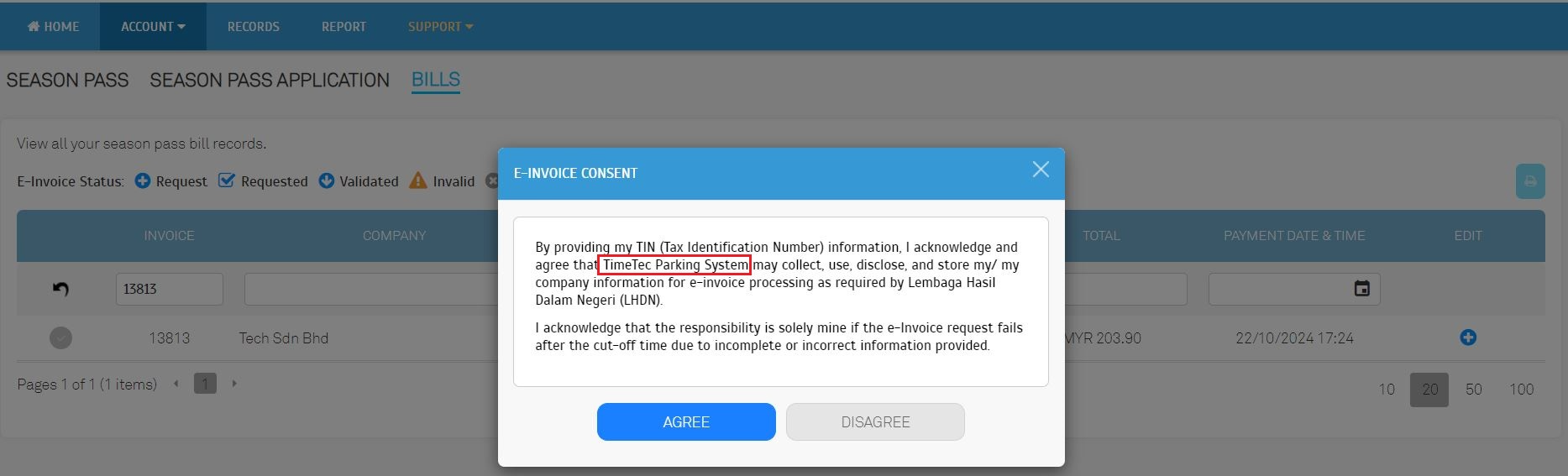

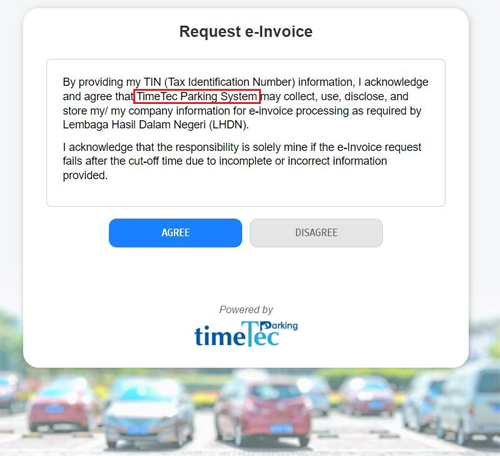

| We have further improved the e-invoice consent process by enhancing the content of the consent form. This update ensures that customers have a clear understanding of the terms and conditions associated with e-invoice processing. Key Improvements: • Clear and Concise Language: The consent form is written in plain language, making it easy for customers to comprehend. • Transparent Information: The form provides detailed information about the benefits of e-invoicing, data privacy practices, and any potential risks. • Informed Consent: By providing comprehensive information, TimeTec empowers customers to make informed decisions about their consent. This enhancement strengthens the trust between businesses and customers, fostering a more transparent and efficient e-invoicing ecosystem. |

|

|

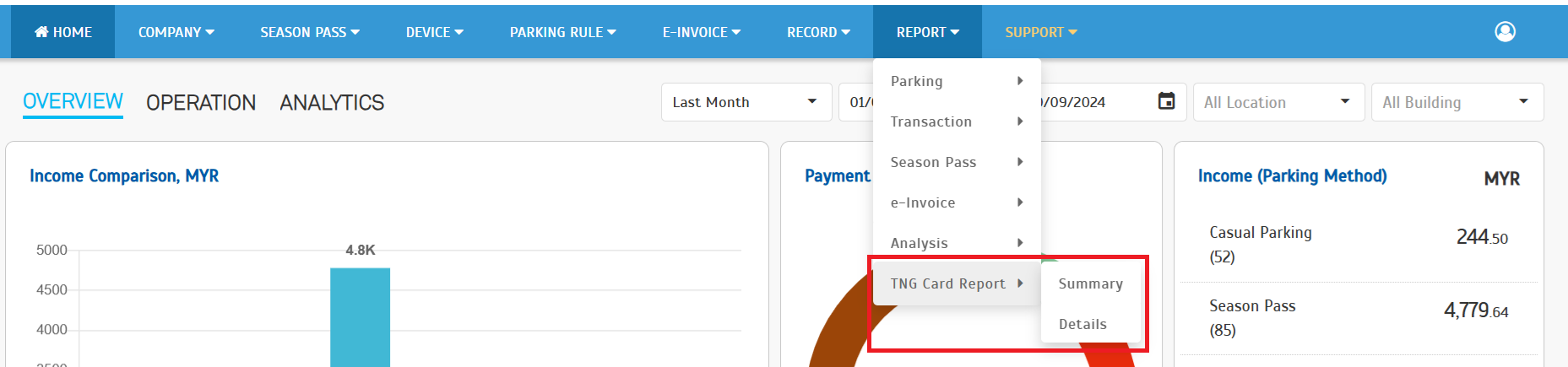

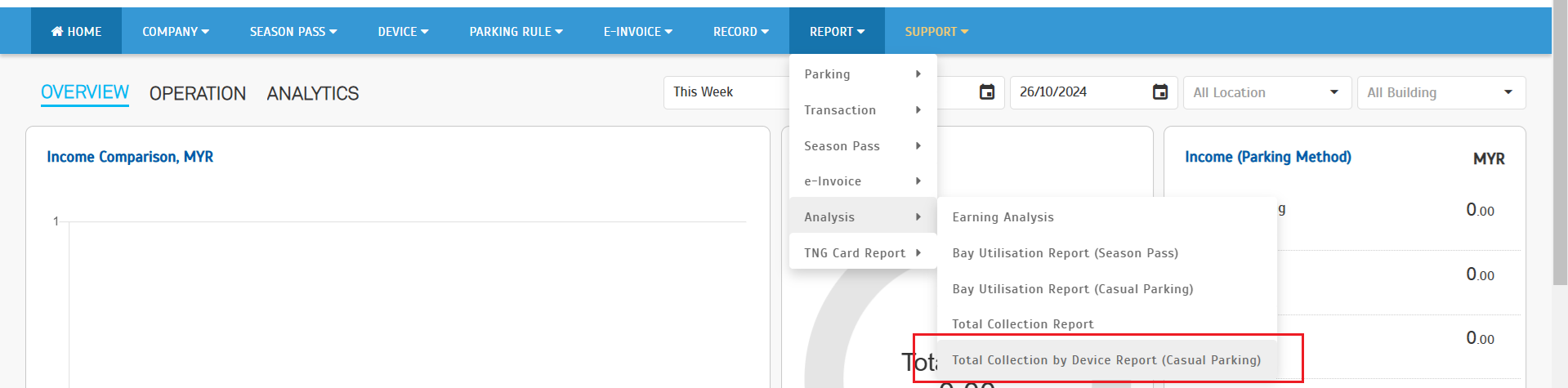

| To enhance clarity and user experience, we've renamed the "Settlement Report" section to "TNG Card Report." Renaming the section makes it easier to locate reports related to TNG card transactions. The following reports are now accessible under the "TNG Card Report" section: • Summary: Provides a high-level overview of TNG card transactions, including total amounts and key metrics. • Details: Offers a detailed breakdown of individual TNG card transactions, including transaction dates, times, amounts, and other relevant information. This reorganization will help operators quickly find the necessary reports to analyze TNG card usage and financial performance. |

|

| We introduced a new filter to the Payment Transaction Listing report, enabling operators to easily identify and review abnormal transactions. This filter allows operators to: • Quickly Identify Unusual Activity: Pinpoint transactions that deviate from normal patterns or exhibit suspicious behavior. • Conduct Thorough Investigations: Analyze flagged transactions to determine the root cause of the abnormality. • Prevent Fraud and Loss: Take proactive measures to mitigate risks and protect the business. By providing a targeted view of abnormal transactions, we empower operators to maintain the financial security and integrity. |

|||

|

| We introduced a new report, Total Collection by Device Report (Casual Parking), to provide valuable insights into revenue generation from casual parking operations. This report offers a detailed breakdown of parking fees collected through different devices, including: • Payment Kiosks: Analyze the performance of individual kiosks and identify potential issues. • Mobile Apps: Track the adoption of mobile payment options and optimize marketing strategies. • Card Readers: Monitor the effectiveness of card-based payment methods. By leveraging this report, operators can make data-driven decisions to improve revenue collection, enhance customer experience, and optimize resource allocation. Operators can easily analyse revenue sources and manage collections effectively. |

|

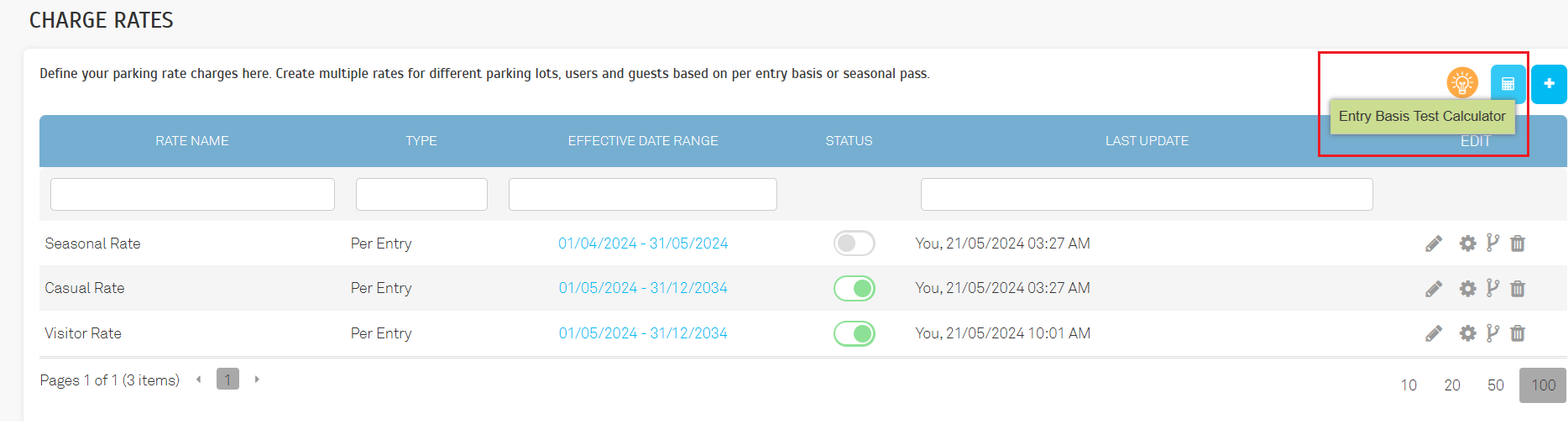

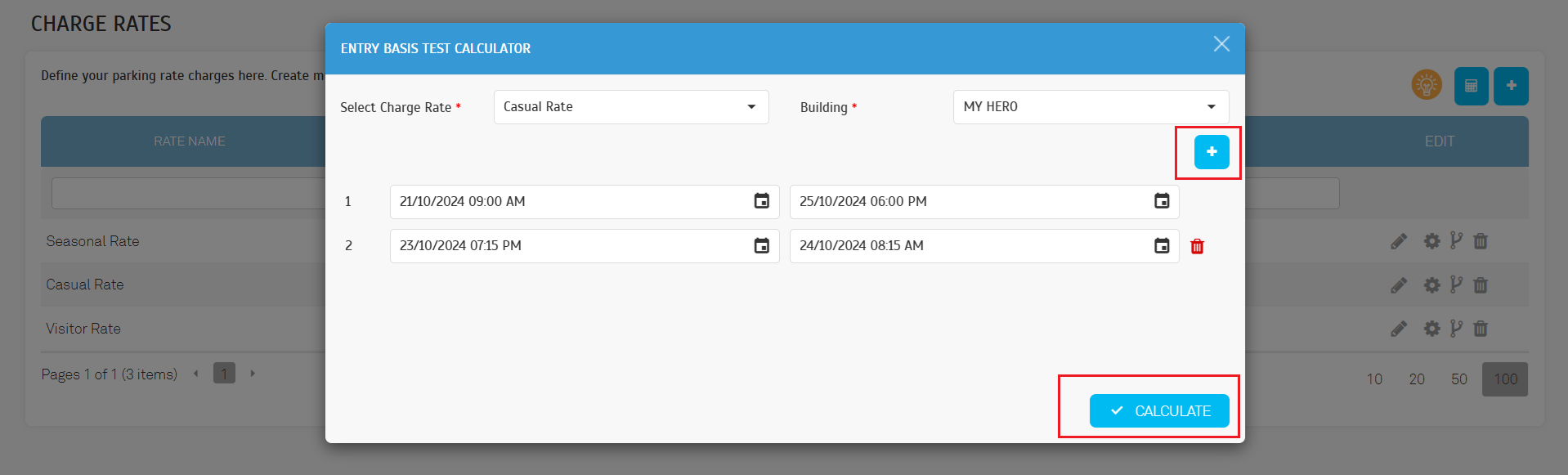

| Tariff Testing and Validation We introduced a new Tariff Testing Calculator to help operators fine-tune and verify rate calculations before deploying them in the live environment. This powerful tool allows operators to: • Simulate Scenarios: Create various scenarios to test different rate configurations and edge cases. • Validate Calculations: Ensure that rate calculations are accurate and consistent. • Identify and Resolve Errors: Detect and correct any potential issues in the tariff logic. By providing a controlled testing environment, we empower operators to minimize the risk of errors and optimize the revenue generation. |

|

|

| Previous Issue: October 2024 |